Hidden on the second page of the local section of the Post-Gazette was this article about the apparent $25 Million surplus in the City of Pittsburgh coffers. Of course, there was some accounting shuffling, apparently recording revenues prior to them being received, but good news, I suppose.

The balance of the article, however, was taken up on the plan floated to refinance the existing municipal bond obligations.

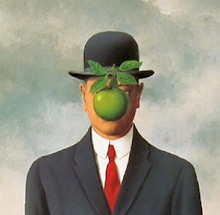

The city of Pittsburgh should scrap an emerging plan to refinance debt and borrow more money, acting Controller Tony Pokora said yesterday.I'm trying to find a good (read: "free") site that will give the City of Pittsburgh's Current municipal Bond Rating. Closest I can find is this old thing, which gives the City an enthusiastic "not quite junk" anymore rating. So, in light of the inability of me to actually find a good site, suffice it to say that I can't back up the following statement with "proof": the City of Pittsburgh's bond rating is not in the toilet as some may suppose. Rather, it is hovering over the toilet like a soused fraternity jock after a hard St. Patrick's Day, crying that, as God as it's witness, it will never drink like that again.

"Any new debt adds to the burden," which now eats up nearly one-quarter of the budget, he said upon the release of the city's annual audit...

Meanwhile, pension and employee benefits costs are rising, and debt payments remain around $100 million a year.

The city's debt is $789 million, or $2,359 per resident.

Mayor Bob O'Connor's plan to refinance debt and net the city $50 million for repairs is a bad move, said Mr. Pokora.

"With the debt structure we're in now, before we issue new debt, we should get some state help," Mr. Pokora said. The refinancing plan would push up debt payments in later years, he said, postponing a dip in debt set for early next decade.

Mayoral spokesman Dick Skrinjar said the administration plans to stretch the $50 million over three years, "for repairs and capital work that have been neglected." He said J.P. Morgan Securities and PNC Bank are expected to be the lenders.

Henry Sciortino, executive director of the state-picked Intergovernmental Cooperation Authority, said the city can afford to borrow $50 million for two years of repairs and improvements, if it continues to cut costs.

Failing to fix roads, bridges and walls would "push costs that are only going to escalate off into the future," he said.

Please, soak up that metaphor.

While you are doing that, please consider the following:

(1) What is the Net Present Value of the repairs, new hires, and improvements that the Mayor is planning to undertake, and how does this compare to the Net Present Value of the series of payments that the City will have to undertake over the next [mumble mumble] years to pay off the refinanced debt obligation?

(2) What is the expected cost of not doing repairs, new hires, and improvements over the next two years?

(3) How much of the refinancing will be eaten up by municipal bond insurance, financing fees, etc.?

(4) Is this a wise move to make now, with the current tenuous bond rating, or should we wait until we show some marked improvements?

(5) Where exactly are we going to get the revenue stream necessary to make these payments? New taxes? Reductions in municipal services? Unexpected growth? The Powerball?

(6) How are bond agencies going to look at us as a credit risk if we keep paying off our debts through refinancing (and thereby losing money for those that purchased the bonds?

(7) Are these callable bonds?

(8) Did I read the following correctly: "The refinancing plan would push up debt payments in later years... postponing a dip in debt set for early next decade." Doesn't that mean that there's going to be some significant acceleration or balloon payments in the years to come, making our debt burden even more unbearable in 2020? Isn't this what Murphy was criticized for doing?

(9) Has Paul Leger started drinking the Kool-Aid already?

Now, I'm off to get all fraternity jocked up; public finance does that to me.

No comments:

Post a Comment